san francisco sales tax rate history

Did South Dakota v. The law authorizes counties to impose a sales and use.

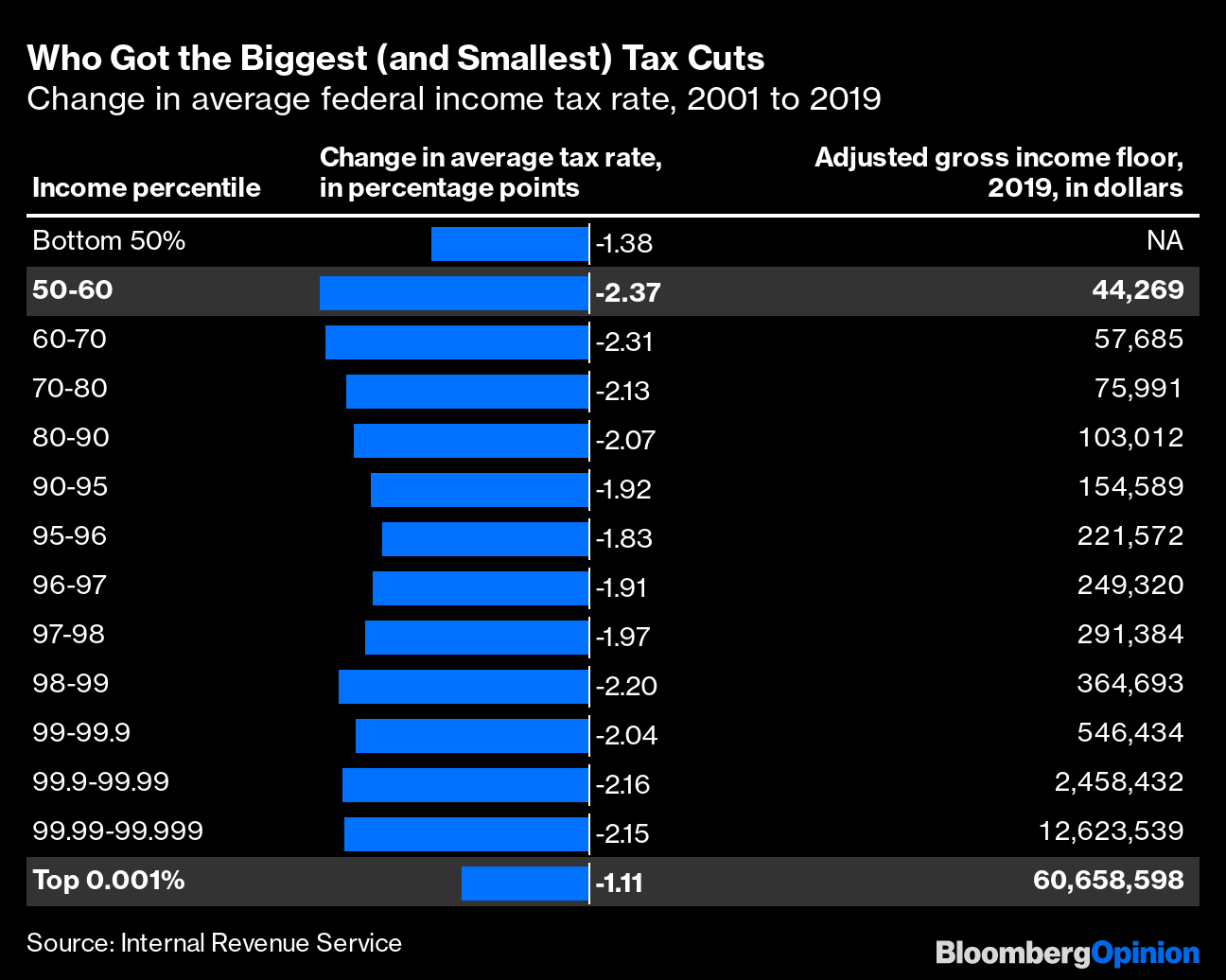

U S Income Tax Policy Is Mostly About The 1 Bloomberg

This is the total of state and county sales tax rates.

. This scorecard presents timely. The estimated 2022 sales tax rate for 94107 is. The current total local sales tax rate in San Francisco CA is 8625.

The minimum combined 2022 sales tax rate for South San Francisco California is. These rates may be outdated. The 2018 United States Supreme Court decision in South Dakota v.

Notes to Rate History Table. The San Francisco County California sales tax is 850 consisting of 600 California state sales tax and 250 San Francisco County local sales taxesThe local sales tax consists of a 025. For a list of your current and historical rates go to the.

The minimum combined 2022 sales tax rate for San Francisco County California is. The 2018 United States Supreme Court decision in South Dakota v. What is the sales tax rate in South San Francisco California.

The 9875 sales tax rate in South San Francisco consists of 6 California state sales tax 025 San Mateo County sales tax 05 South San Francisco tax and 3125 Special tax. Until 2018 all businesses with a taxable San Francisco payroll expense greater than 150000 must file a Payroll Expense Tax Statement for their. The California state sales tax rate is currently.

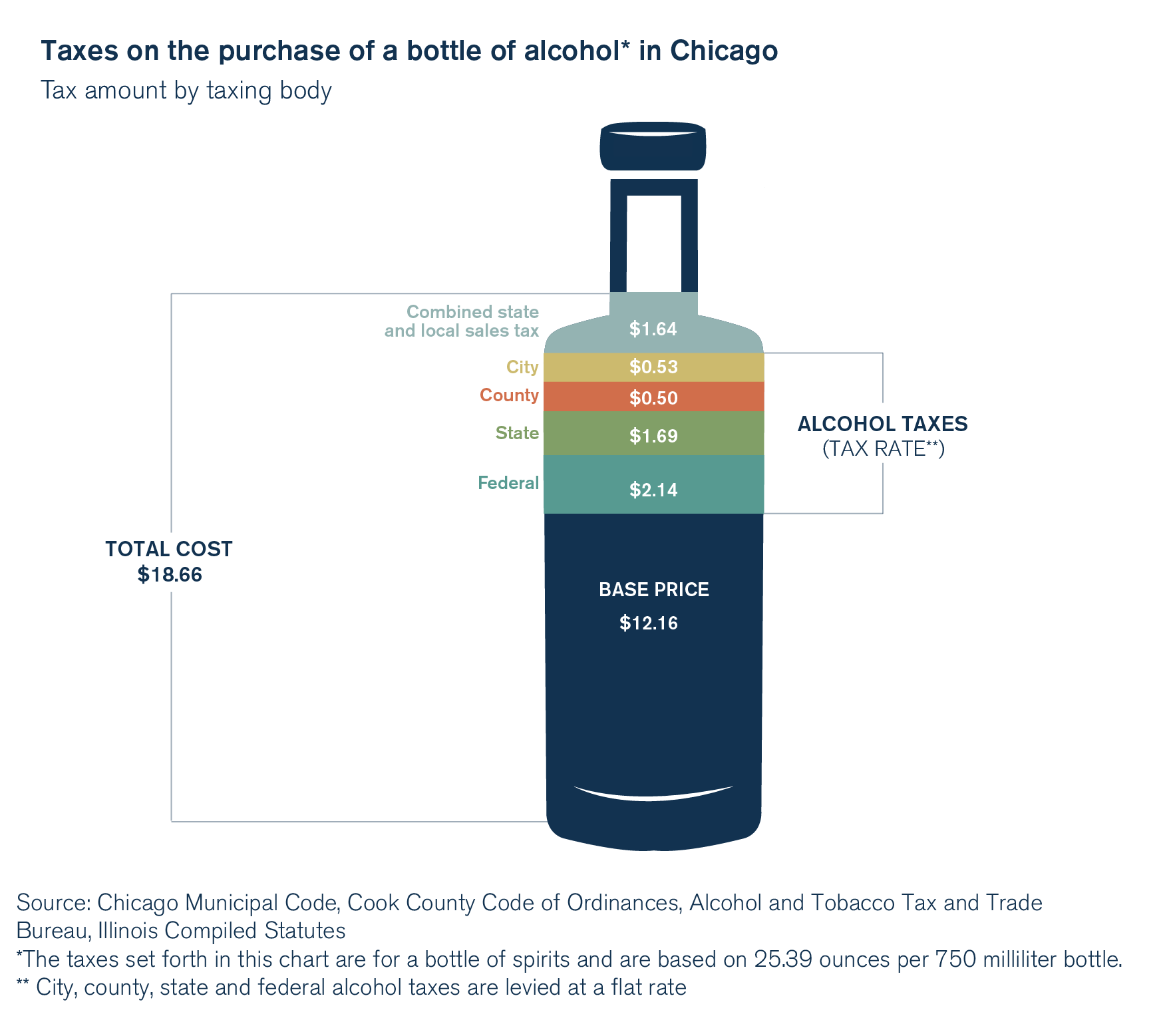

Rates are for total sales tax levied in the City County of San Francisco. The average cumulative sales tax rate in San Francisco California is 864. Effective January 1 2013.

SOLD MAY 16 2022. The Bradley-Burns Uniform Local Sales and Use Tax Law was enacted in 1955. The 8625 sales tax rate in San Francisco consists of 6 California state sales tax 025 San Francisco County sales tax and 2375.

The rates display in the files below represents total Sales and Use Tax Rates state local county and district where applicable. California City and County Sales and Use Tax Rates Rates Effective 10012018 through 03312019 City Rate County Acampo 7750 San Joaquin Acton 9500 Los Angeles Adelaida. The purpose of the Economy scorecard is to provide the public elected officials and City staff with a current snapshot of San Franciscos economy.

Historical Tax Rates in California Cities Counties. 1788 rows California City County Sales Use Tax Rates effective October 1 2022. The 8625 sales tax rate in San Francisco consists of 6 Puerto Rico state sales tax 025 San Francisco County sales tax and 2375 Special tax.

Payroll Expense Tax. The current total local sales tax rate in South San Francisco CA is 9875. The December 2020 total local sales tax rate was 8500.

This includes the rates on the state county city and special levels. This is the total of state county and city sales. Has impacted many state nexus laws and sales tax collection.

Citys General Fund Local Portion is 1 of the total rate throughout the period shown. The transfer tax rate had been previously unchanged since 1967. The current total local sales tax rate in San Francisco County CA is 8625.

There is no applicable city tax. 2150000 Last Sold Price. Nearby homes similar to 1727 Newcomb Ave have recently sold between 785K to 2700K at an average of 905 per square foot.

Rates are for total sales tax levied in the City County of San Francisco. The December 2020 total local sales tax rate was 8500. The December 2020 total local sales tax rate was 9750.

For a more detailed breakdown. Wayfair Inc affect California. The San Francisco sales tax rate is.

0875 lower than the maximum sales tax in CA.

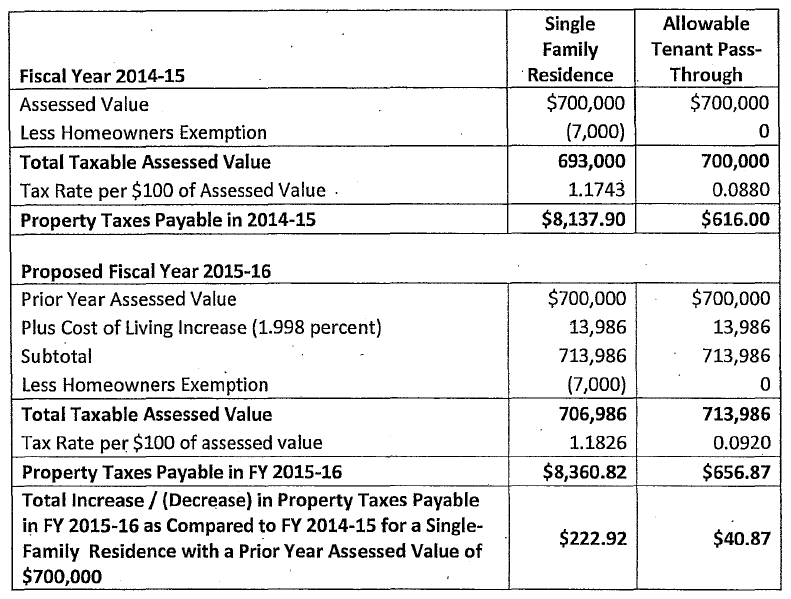

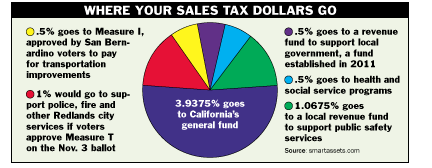

San Francisco Property Tax Rate To Rise Where The Dollars Will Go

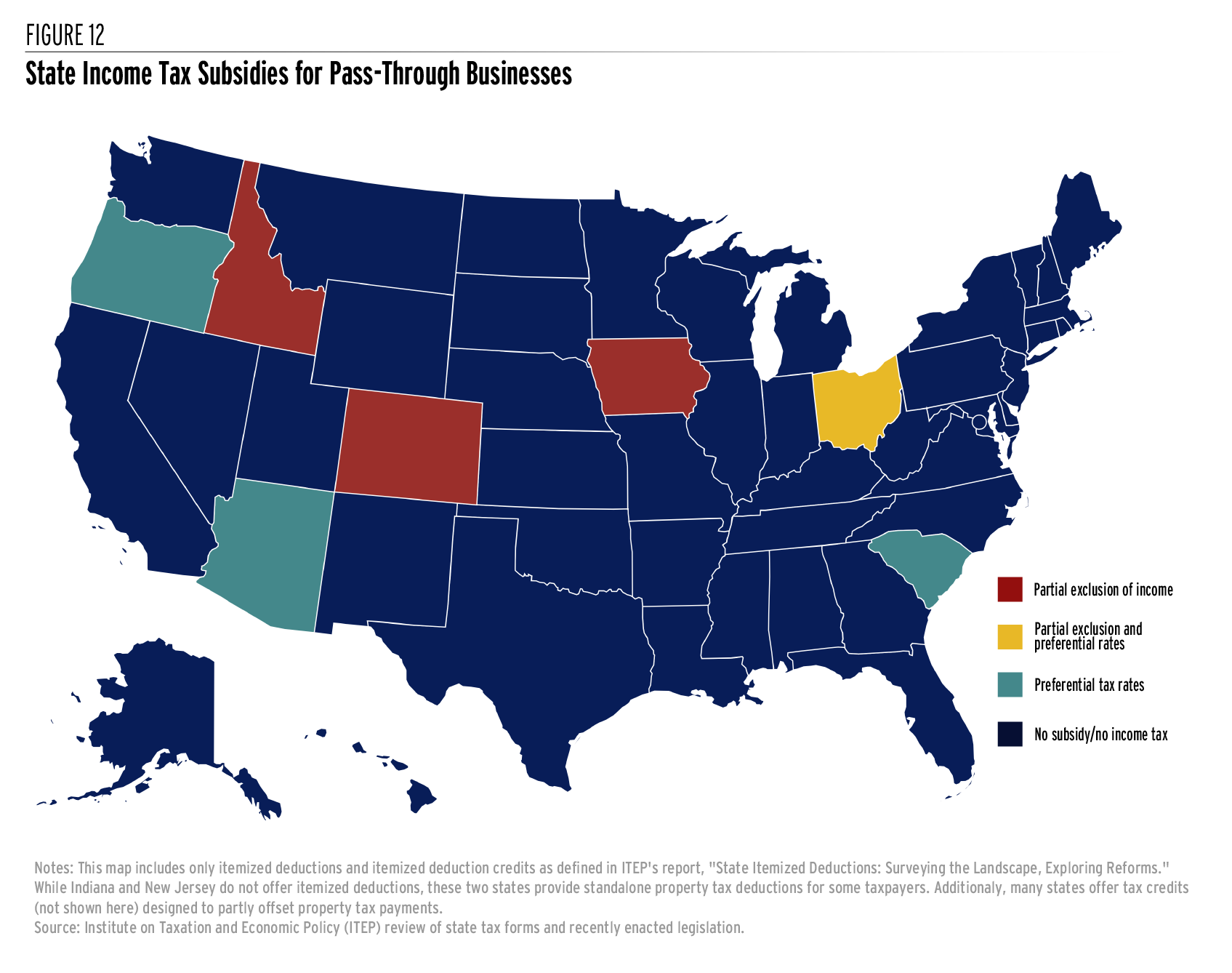

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

How Wayfair And Covid Spurred A State Sales Tax Bonanza Bloomberg

Sales Tax Rates Reached 10 Year High In 2020 Accounting Today

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

Secured Property Taxes Treasurer Tax Collector

The History Of California Sales Taxes Redlandscommunitynews Com

Local Income Taxes In 2019 Local Income Tax City County Level

Tax Guide Best City To Buy Legal Weed In California Leafly

The Open Secret About California Taxes Calmatters

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

Sales Tax Is Rising In San Francisco And These Bay Area Cities This Week

What The 15 Corporate Minimum Tax Means For Tech Protocol

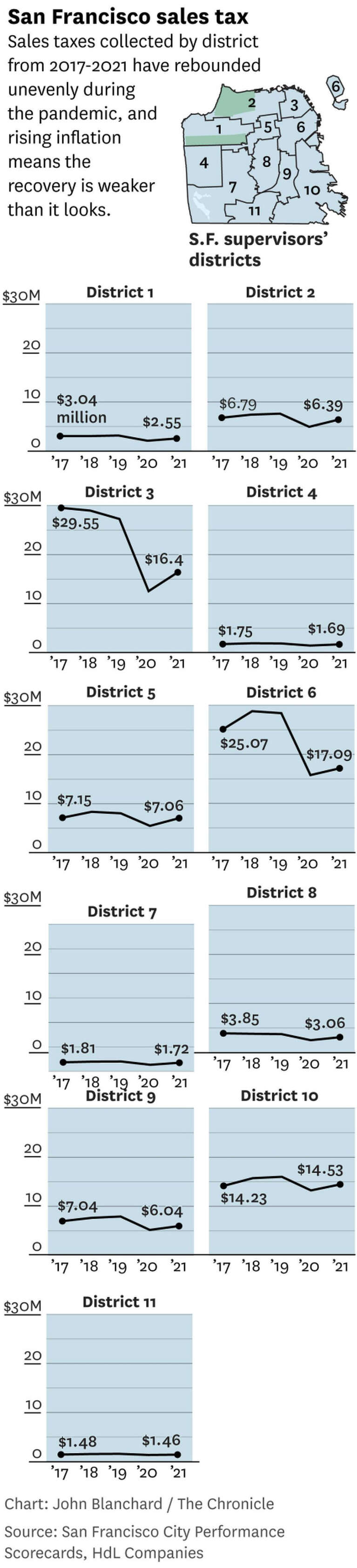

Downtown Vs Neighborhoods S F Sales Tax Data Shows Where People Are Spending Their Money

California Sales Tax Rate Changes January 2013 Avalara

Taxation In California Wikipedia

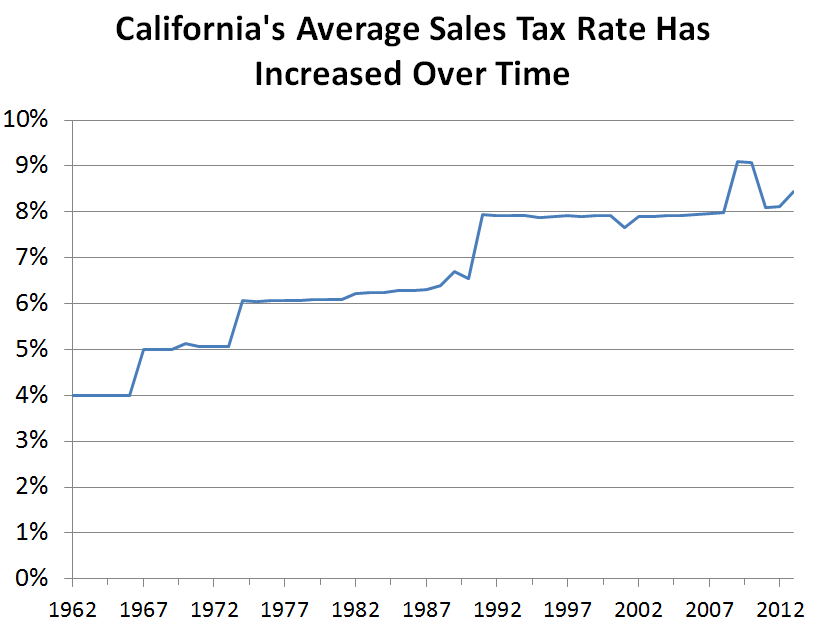

California S Sales Tax Rate Has Grown Over Time Econtax Blog